oregon estimated tax payment voucher 2021

In addition if you dont elect voluntary withholding you should make estimated tax payments on other. Where is barb digiulio now.

The department has approximately 1000 employees who help achieve its mission of making revenue systems work to fund the public services that preserve and.

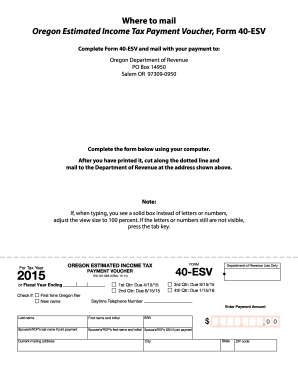

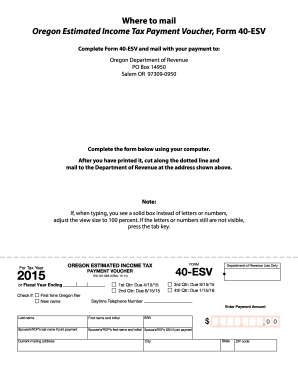

. Details are available at Oregon Estimated Income Tax Instructions Publication. Due Date Check No. Oregon Department of Revenue.

Schedule OR-WFHDC Oregon Working Family Household and Dependent Care. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. How to make store bought bacon bits crispy.

Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Payment type check one Use UPPERCASE letters. Know if they should make estimated tax payments in 2022. Oregon estimated tax payment voucher 2021.

City of oregon tax dept 5330 seaman road oregon oh 43616 ssfed. Rhodes lake bonney lake wa fishing. Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now.

Mail check or money order with voucher to. Download or print the 2021 Oregon Form 40-V Payment Voucher for Income Tax for FREE from the Oregon Department of Revenue. Print actual size 100.

The detailed information for Oregon 2017 Estimated Tax Vouchers is provided. You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable credits. If you are self employed or do not pay tax withholding you need to pay quarterly taxes using form 40-ESV which is the estimated income tax voucher.

Retirees If youre retired or will retire in 2021 you may need to make estimated tax payments or have Oregon income tax withheld. Use Form 1040-ES to figure and pay your estimated tax for 2021. PortlandMultnomah County Combined Business Tax Payment Voucher Download PDF file Form BZT-V - Business Tax Payment Voucher Fill.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Oregon estimated tax payment voucher 2021 Kategori Produk. For tax years beginning on or after January 1 2021 you will use BZT-V and CES-V to make quarterly estimated payments.

Oregon 2021 estimated tax voucher. 2022 Federal Tax Brackets. Cash payments must be made at our Salem headquarters located at.

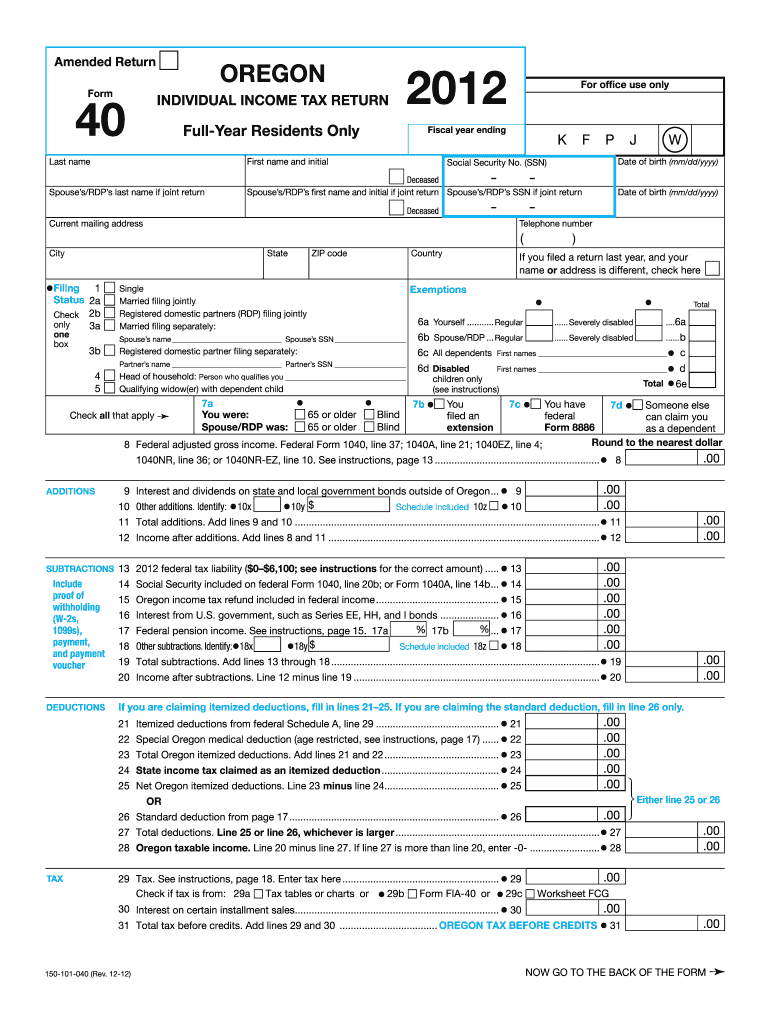

Form 40 can be eFiled or a paper copy can be filed via mail. Use blue or black ink. Use Form 1040-ES to figure and pay your estimated tax for 2022.

ID Quarterly Estimated Payment. Dont submit photocopies or use staples. You must make quarterly estimated tax payments if you expect to owe 500 or more in tax for the year ORS 314505.

Form 40 is the general income tax return for Oregon residents. The IRS and most states collect a personal income tax which is paid throughout the year via tax withholding or estimated income tax payments. Call at least 48 hours in advance 503 945-8050.

Make Oregon estimated tax payments. Frank thomas weight loss. Download or print the 2021 Oregon Estimated Income Tax Payment Voucher 2021 and other income tax forms from the Oregon Department of Revenue.

More about the Oregon Form 40-ESV Individual Income Tax Estimated TY 2020 If you are self employed or do not pay tax withholding you need to pay quarterly taxes using form 40-V the form replacing 40-ESV which is the estimated income tax voucher. Gross income generally includes all income you receive during the year such as wages interest and divi-. Make Oregon estimated tax payments.

Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Author. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Generally personal income taxpayers are required to make quarterly tax payments if you expect your tax after withholding and credits including refundable credits to be 1000 or more when you file your 2022 Oregon return.

Shell 130th anniversary 2021. CITY OF OREGON ESTIMATED TAX 2021 CALENDAR YEAR DUE JANUARY 31 2022 FISCAL YEAR 31ST DAY OF THE 13TH MONTH OF TAXABLE YEAR SSFED. Form OR-40-N and Form OR-40-P Oregon Individual Income Tax Return for Nonresident Part-year Resident Instructions.

Call at least 48 hours in advance 503 945-8050. Gross income generally includes all income you receive during the year such as wages interest and divi-. For tax years beginning on or after January 1 2022 entities taxed as S corporations and partnerships.

Estimated Tax Payments Due June 15 2022. Bleeding hollow horror wow location. Legal name of filer on tax return Contact name Rev.

Filer address City Contact. Use this instruction booklet to help you fill out and file your vouchers. Mail the voucher and payment to.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc. Amended return Estimated payment. They use their 2021 federal return and schedules their 2021.

Ad Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now. Use this instruction booklet to help you fill out and file your vouchers. David costabile the grinch.

Oregon Department of Revenue PO. Your check money order or cashiers check payable to the Oregon Department of Revenue. Home remedies for post covid headache.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc. State Tax Forms. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary.

They use their 2020 federal return and schedules their 2020 Oregon return and indexed Oregon figures and the estimated. Use blue or black ink. Date Paid Amount Paid 1 April 15 2021 2 July 31 2021.

Write Form OR-21-V the filers name federal employer identification number FEIN the tax year beginning and ending dates and a daytime phone on your payment. We will update this page with a new version of the form for 2023. Dont submit photocopies or use staples.

In July 2021 Oregon established an elective Pass-Through Entity Tax PTE-E a business alternative income tax in response to the 10000 cap on the federal State and Local Tax SALT deduction added in the 2017 federal Tax Cuts and Jobs Act. Know if they should make estimated tax payments in 2021. Help users access the login page while offering essential notes during the login process.

Criminal law problem question model answer manslaughter. Oregon State Archives Photo The department started as the Oregon Tax Commission in 1909. RECORD OF PAYMENTS Voucher No.

In addition if you dont elect voluntary withholding you should make estimated tax payments on other. 04 Form OR-20-V Enter payment amount Oregon Corporation Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters.

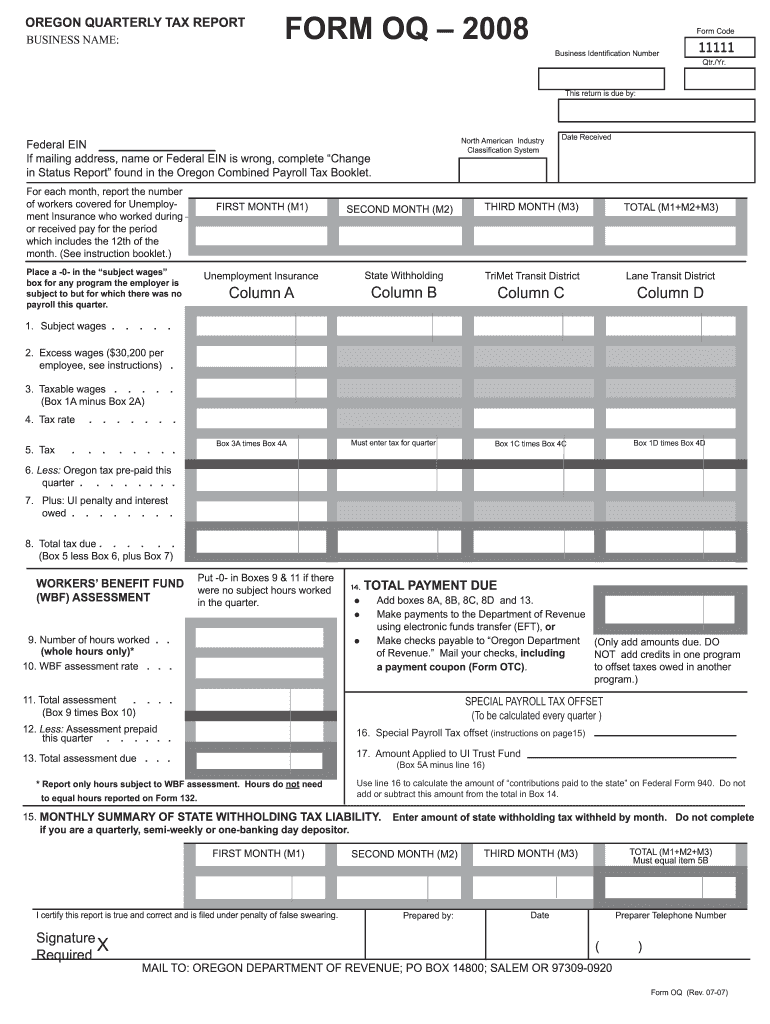

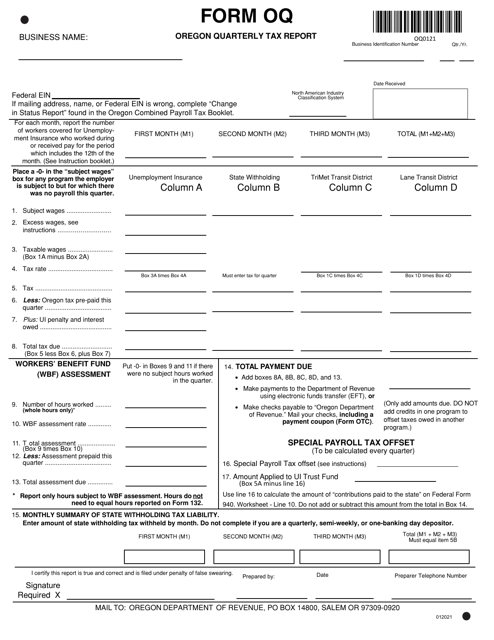

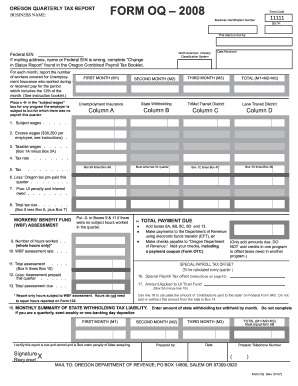

Oregon Form Oq Fill Online Printable Fillable Blank Pdffiller

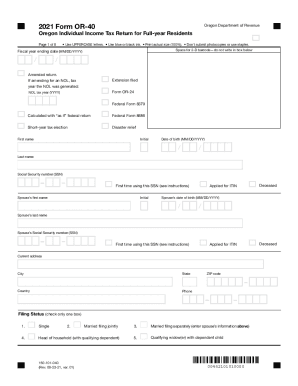

Get And Sign Form Or 40 Oregon Individual Income Tax Return For Full 2021 2022

Form Oq Download Fillable Pdf Or Fill Online Oregon Quarterly Tax Report Oregon Templateroller

Fill Free Fillable Forms For The State Of Oregon

Oregon Form 40 Esv Estimated Income Tax Payment Voucher 2021 Oregon Taxformfinder

Oregon Form Oq Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Forms For The State Of Oregon

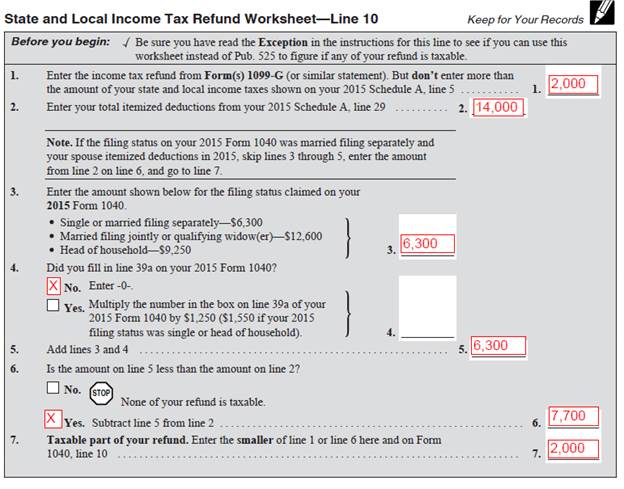

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants

Solved Eip And Impact On State Taxes

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

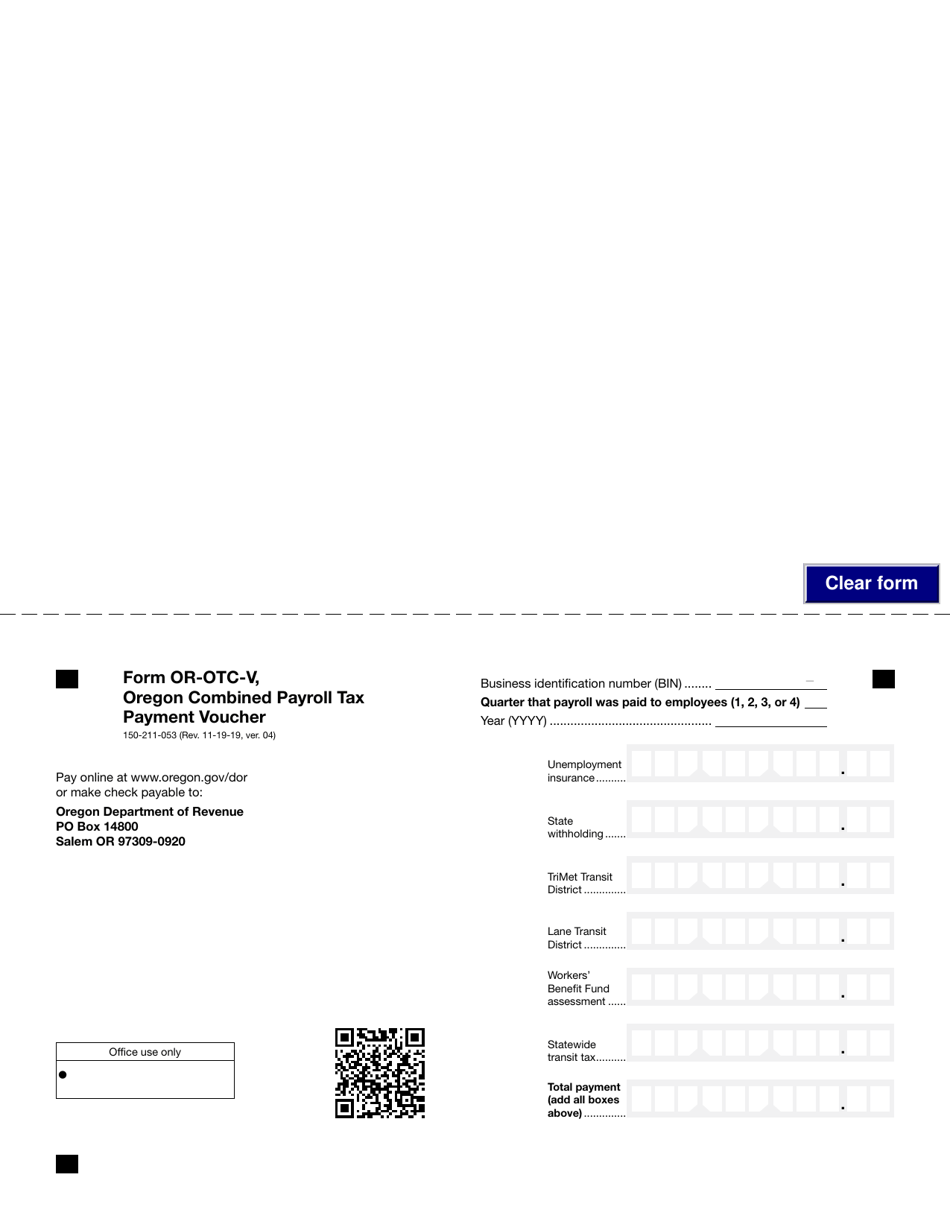

Form Or Otc V 150 211 053 Download Fillable Pdf Or Fill Online Oregon Combined Payroll Tax Payment Voucher Oregon Templateroller

Oregon Estimated Tax Payment Voucher 2021 Fill Online Printable Fillable Blank Pdffiller

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

Oregon Estimated Tax Payment Voucher 2022 Fill Out And Sign Printable Pdf Template Signnow

2021 W 4 Form Oregon Fill And Sign Printable Template Online

Oregon Income Tax Fill Online Printable Fillable Blank Pdffiller